Renters Insurance in and around Birmingham

Welcome, home & apartment renters of Birmingham!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

There’s No Place Like Home

Think about all the stuff you own, from your laptop to bookshelf to sports equipment to hiking shoes. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Welcome, home & apartment renters of Birmingham!

Renting a home? Insure what you own.

There's No Place Like Home

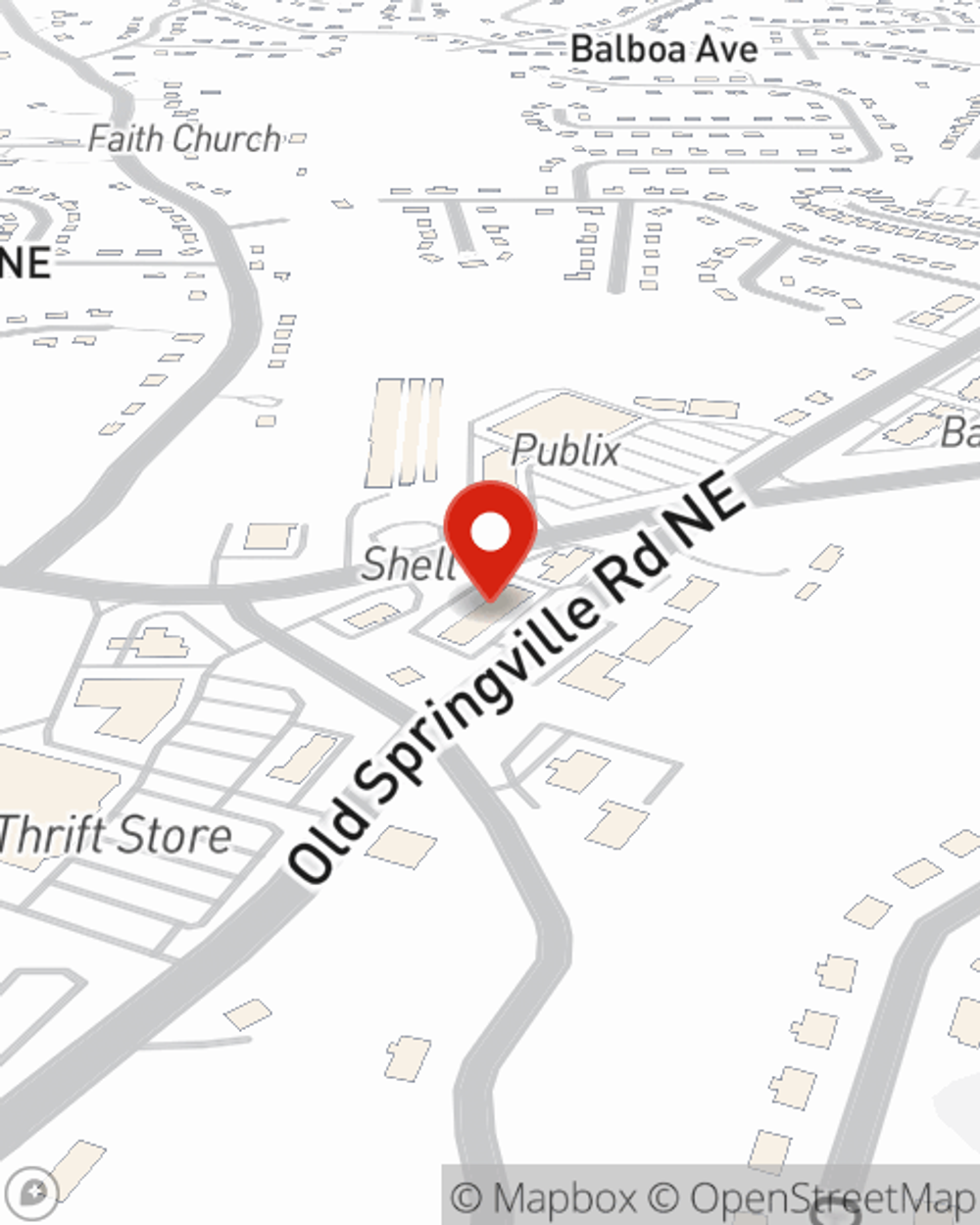

Renting is the smart choice for lots of people in Birmingham. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover water damage to walls and floors or an abrupt leak that causes water damage, that doesn't cover the things you own Finding the right coverage helps your Birmingham rental be a sweet place to be. State Farm has coverage options to fit your specific needs. Thankfully you won’t have to figure that out alone. With empathy and fantastic customer service, Agent Lee Strong can walk you through every step to help you set you up with a plan that guards the rental you call home and everything you’ve invested in.

There's no better time than the present! Contact Lee Strong's office today to discover the benefits of a State Farm renters policy.

Have More Questions About Renters Insurance?

Call Lee at (205) 538-5854 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.